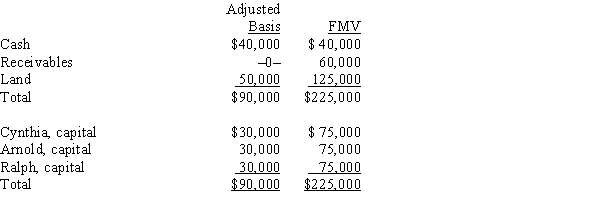

Cynthia sells her 1/3 interest in the CAR Partnership to Brandon for $95,000 cash. On the date of sale, the partnership balance sheet and agreed-upon fair market values were as follows:  If the partnership has a § 754 election in effect, the total "step-up" in basis of partnership assets that will be allocated to Brandon is:

If the partnership has a § 754 election in effect, the total "step-up" in basis of partnership assets that will be allocated to Brandon is:

A) $75,000.

B) $65,000.

C) $45,000.

D) $20,000.

E) $0.

Correct Answer:

Verified

Q75: Which of the following is not typically

Q75: The December 31, 2014, balance sheet of

Q76: Which of the following distributions would never

Q77: The December 31, 2014, balance sheet of

Q80: Which of the following statements about the

Q111: Match the following statements with the best

Q114: Match the following statements with the best

Q132: Nicholas is a 25% owner in the

Q135: Which of the following statements is true

Q174: Match each of the following statements with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents