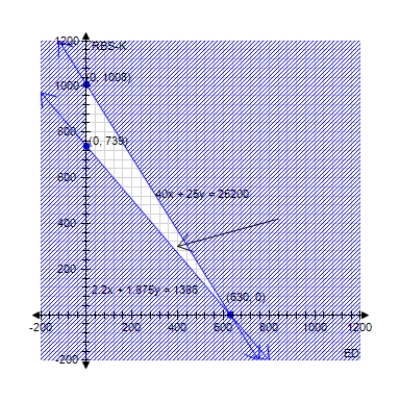

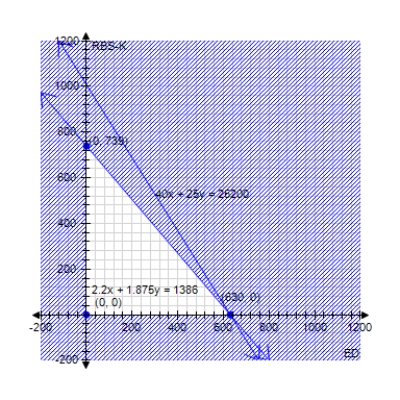

Your friend's portfolio manager has suggested two high-yielding stocks: Consolidated Edison (ED) and Royal Bank of Scotland (RBS-K) . ED shares cost $40 and yield 5.5% in dividends. RBS-K shares cost $25 and yield 7.5% in dividends. You have up to $25,200 to invest, and would like to earn at least $1,386 in dividends. Draw the feasible region that shows how many shares in each company you can buy. Find the corner points of the region. (Round each coordinate to the nearest whole number.)

Let the number of shares in ED be x, and the number of shares in RBS-K be y.

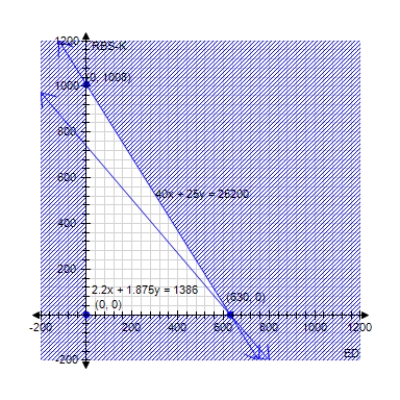

A)

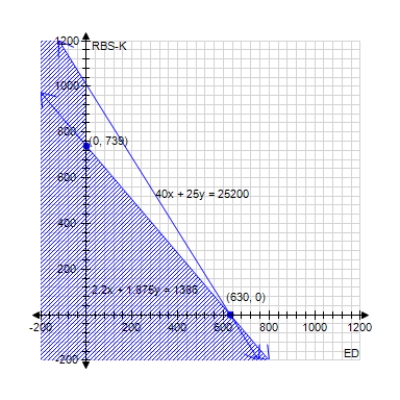

B)

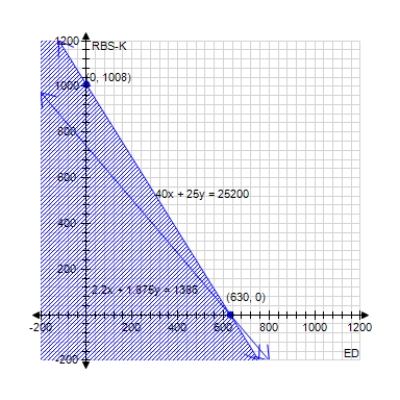

C)

D)

E)

Correct Answer:

Verified

Q151: Determine graphically the solution set for

Q152: Graph the solution set to the

Q153: Graph the solution set to the

Q154: Given the set of constraints

?

Q155: Which system does the graph satisfy

Q156: Each serving of Gerber Mixed Cereal for

Q157: Enormous State University's Business School is buying

Q158: Graph the solution set to the

Q159: Select the correct graph of the

Q160: Graph the solution set to the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents