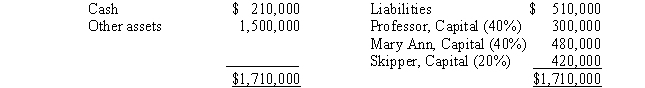

The following balance sheet information is for the partnership of Professor, Mary Ann, and Skipper:  Figures shown parenthetically reflect agreed profit and loss sharing percentages.

Figures shown parenthetically reflect agreed profit and loss sharing percentages.

If the assets are fairly valued on the above balance sheet and the partnership wishes to admit Mrs.Howell as a new 1/5 partner without recording goodwill or bonus, Mrs.Howell should invest cash or other assets of

A) $427,500.

B) $240,000.

C) $300,000.

D) $342,000.

Correct Answer:

Verified

Q2: Bob and Fred form a partnership and

Q6: The profit and loss sharing ratio should

Q8: A partnership in which one or more

Q16: The partnership of Abel and Caine

Q18: The partnership of Gilligan, Skipper, and

Q22: What are some of the methods commonly

Q23: Donkey desires to purchase a one-fourth capital

Q24: Rodgers and Michael formed a partnership on

Q25: The balance sheet for the partnership of

Q26: Describe the tax treatment of partnership income.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents