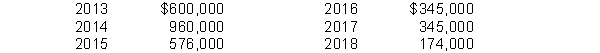

Lehman Corporation purchased a machine on January 2, 2013, for $3,000,000. The machine has an estimated 5-year life with no salvage value. The straight-line method of depreciation is being used for financial statement purposes and the following MACRS amounts will be deducted for tax purposes:  Assuming an income tax rate of 30% for all years, the net deferred tax liability that should be reflected on Lehman's balance sheet at December 31, 2014 be

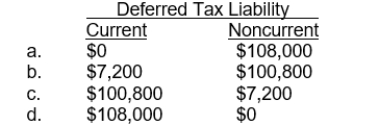

Assuming an income tax rate of 30% for all years, the net deferred tax liability that should be reflected on Lehman's balance sheet at December 31, 2014 be

Correct Answer:

Verified

Q40: Assuming a 40% statutory tax rate applies

Q41: Deferred tax amounts that are related to

Q42: Major reasons for disclosure of deferred income

Q43: Use the following information for questions 58

Q44: Accounting for income taxes can result in

Q46: Recognizing a valuation allowance for a deferred

Q47: With regard to uncertain tax positions, the

Q48: Use the following information for questions 52

Q49: A deferred tax liability is classified on

Q50: Deferred taxes should be presented on the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents