Use the following information for questions 52 and 53.

At the beginning of 2015, Pitman Co. purchased an asset for $1,200,000 with an estimated useful life of 5 years and an estimated salvage value of $100,000. For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used. Pitman Co.'s tax rate is 40% for 2015 and all future years.

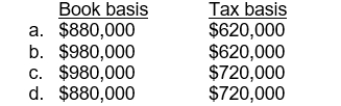

-At the end of 2015, what are the book basis and the tax basis of the asset?

Correct Answer:

Verified

Q43: Use the following information for questions 58

Q44: Accounting for income taxes can result in

Q45: Lehman Corporation purchased a machine on January

Q46: Recognizing a valuation allowance for a deferred

Q47: With regard to uncertain tax positions, the

Q49: A deferred tax liability is classified on

Q50: Deferred taxes should be presented on the

Q51: Use the following information for questions 55

Q52: Use the following information for questions 58

Q53: Recognition of tax benefits in the loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents