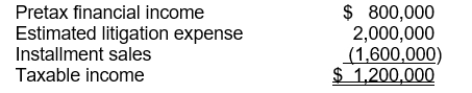

Use the following information for questions 55 through 57.

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

-The deferred tax asset to be recognized is

A) $0.

B) $120,000 current.

C) $600,000 current.

D) $600,000 noncurrent.

Correct Answer:

Verified

Q46: Recognizing a valuation allowance for a deferred

Q47: With regard to uncertain tax positions, the

Q48: Use the following information for questions 52

Q49: A deferred tax liability is classified on

Q50: Deferred taxes should be presented on the

Q52: Use the following information for questions 58

Q53: Recognition of tax benefits in the loss

Q54: Use the following information for questions 55

Q55: Use the following information for questions 58

Q56: All of the following are procedures for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents