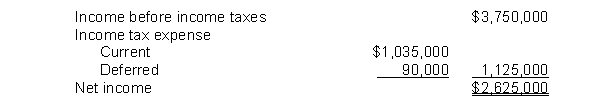

Eckert Corporation's partial income statement after its first year of operations is as follows:  Eckert uses the straight-line method of depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The amount charged to depreciation expense on its books this year was $2,400,000. No other differences existed between book income and taxable income except for the amount of depreciation. Assuming a 30% tax rate, what amount was deducted for depreciation on the corporation's tax return for the current year?

Eckert uses the straight-line method of depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The amount charged to depreciation expense on its books this year was $2,400,000. No other differences existed between book income and taxable income except for the amount of depreciation. Assuming a 30% tax rate, what amount was deducted for depreciation on the corporation's tax return for the current year?

A) $2,100,000

B) $1,125,000

C) $2,400,000

D) $2,700,000

Correct Answer:

Verified

Q59: Tanner, Inc. incurred a financial and taxable

Q60: Uncertain tax positions

I.Are positions for which the

Q61: Use the following information for questions 79

Q62: In 2014, Krause Company accrued, for financial

Q63: Use the following information for questions 66

Q65: Use the following information for questions 79

Q66: Watson Corporation prepared the following reconciliation for

Q67: Use the following information for questions 70

Q68: Ewing Company sells household furniture. Customers who

Q69: Use the following information for questions 76-78.

At

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents