Use the following information for questions 79 and 80.

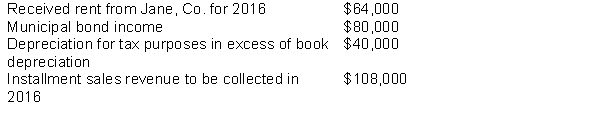

Rowen, Inc. had pre-tax accounting income of $1,800,000 and a tax rate of 40% in 2015, its first year of operations. During 2015 the company had the following transactions:

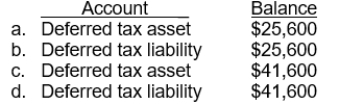

-At the end of 2015, which of the following deferred tax accounts and balances is reported on Rowen, Inc.'s balance sheet?

Correct Answer:

Verified

Q56: All of the following are procedures for

Q57: Use the following information for questions 55

Q58: Use the following information for questions 52

Q59: Tanner, Inc. incurred a financial and taxable

Q60: Uncertain tax positions

I.Are positions for which the

Q62: In 2014, Krause Company accrued, for financial

Q63: Use the following information for questions 66

Q64: Eckert Corporation's partial income statement after its

Q65: Use the following information for questions 79

Q66: Watson Corporation prepared the following reconciliation for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents