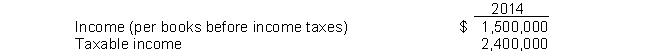

Cross Company reported the following results for the year ended December 31, 2014, its first year of operations:  The disparity between book income and taxable income is attributable to a temporary difference which will reverse in 2015. What should Cross record as a net deferred tax asset or liability for the year ended December 31, 2014, assuming that the enacted tax rates in effect are 40% in 2014 and 35% in 2015?

The disparity between book income and taxable income is attributable to a temporary difference which will reverse in 2015. What should Cross record as a net deferred tax asset or liability for the year ended December 31, 2014, assuming that the enacted tax rates in effect are 40% in 2014 and 35% in 2015?

A) $360,000 deferred tax liability

B) $315,000 deferred tax asset

C) $360,000 deferred tax asset

D) $315,000 deferred tax liability

Correct Answer:

Verified

Q66: Watson Corporation prepared the following reconciliation for

Q67: Use the following information for questions 70

Q68: Ewing Company sells household furniture. Customers who

Q69: Use the following information for questions 76-78.

At

Q70: Ferguson Company has the following cumulative taxable

Q72: Horner Corporation has a deferred tax asset

Q73: Use the following information for questions 70

Q74: Use the following information for questions 76-78.

At

Q75: Use the following information for questions 76-78.

At

Q76: Use the following information for questions 70

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents