Use the following information for questions 76-78.

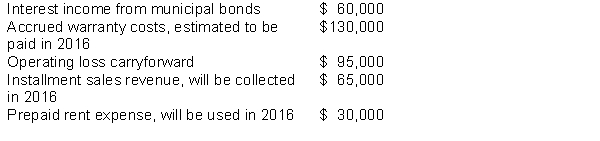

At the beginning of 2015; Elephant, Inc. had a deferred tax asset of $10,000 and a deferred tax liability of $15,000. Pre-tax accounting income for 2015 was $750,000 and the enacted tax rate is 40%. The following items are included in Elephant's pre-tax income:

-Which of the following is required to adjust Elephant, Inc.'s deferred tax asset to its correct balance at December 31, 2015?

A) A credit of $52,000

B) A credit of $38,000

C) A debit of $38,000

D) A debit of $42,000

Correct Answer:

Verified

Q69: Use the following information for questions 76-78.

At

Q70: Ferguson Company has the following cumulative taxable

Q71: Cross Company reported the following results for

Q72: Horner Corporation has a deferred tax asset

Q73: Use the following information for questions 70

Q75: Use the following information for questions 76-78.

At

Q76: Use the following information for questions 70

Q77: The following information is available for Kessler

Q78: Use the following information for questions 73

Q79: Use the following information for questions 66

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents