Use the following information for questions 73 and 74.

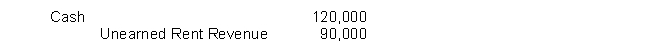

Kraft Company made the following journal entry in late 2014 for rent on property it leases to Danford Corporation.  The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

The payment represents rent for the years 2015 and 2016, the period covered by the lease. Kraft Company is a cash basis taxpayer. Kraft has income tax payable of $184,000 at the end of 2014, and its tax rate is 35%.

-Assuming the income taxes payable at the end of 2015 is $204,000, what amount of income tax expense would Kraft Company record for 2015?

A) $162,000

B) $183,000

C) $225,000

D) $246,000

Correct Answer:

Verified

Q73: Use the following information for questions 70

Q74: Use the following information for questions 76-78.

At

Q75: Use the following information for questions 76-78.

At

Q76: Use the following information for questions 70

Q77: The following information is available for Kessler

Q79: Use the following information for questions 66

Q80: Use the following information for questions 73

Q81: On January 1, 2015, Piper Corp. purchased

Q82: Use the following information for questions 89

Q83: Fleming Company has the following cumulative taxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents