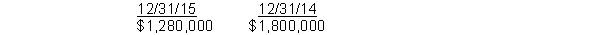

Fleming Company has the following cumulative taxable temporary differences:  The tax rate enacted for 2015 is 40%, while the tax rate enacted for future years is 30%. Taxable income for 2015 is $3,200,000 and there are no permanent differences. Fleming's pretax financial income for 2015 is:

The tax rate enacted for 2015 is 40%, while the tax rate enacted for future years is 30%. Taxable income for 2015 is $3,200,000 and there are no permanent differences. Fleming's pretax financial income for 2015 is:

A) $1,920,000

B) $2,680,000

C) $3,460,000

D) $4,480,000

Correct Answer:

Verified

Q78: Use the following information for questions 73

Q79: Use the following information for questions 66

Q80: Use the following information for questions 73

Q81: On January 1, 2015, Piper Corp. purchased

Q82: Use the following information for questions 89

Q84: Use the following information for questions 93

Q85: Nickerson Corporation began operations in 2013. There

Q86: Based on the following information, compute 2015

Q87: Foltz Corp.'s 2014 income statement had pretax

Q88: Rodd Co. reports a taxable and pretax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents