Present value of an ordinary annuity due.

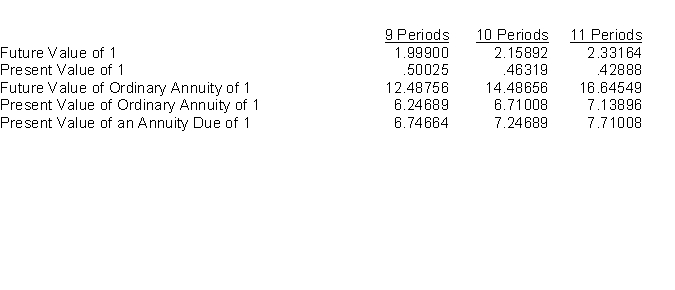

Jill Morris is presently leasing a small business computer from Eller Office Equipment Company. The lease requires 10 annual payments of $5,000 at the end of each year and provides the lessor (Eller) with an 8% return on its investment. You may use the following 8% interest factors:

Instructions

(a) Assuming the computer has a ten-year life and will have no salvage value at the expiration of the lease, what was the original cost of the computer to Eller?

(b) What amount would each payment be if the ten annual payments are to be made at the beginning of each period?

Correct Answer:

Verified

Q139: On January 1, 2014, Ott Co. sold

Q140: Present value of an investment in equipment.

Q141: Under IAS 37 and the establishment of

Q142: IFRS does not intend to issue detailed

Q143: Maxim Company leased an office under a

Q145: Finding the implied interest rate.

Bates Company has

Q146: Under IFRS, the discount rate should reflect

Q147: Reegan Company owns a trade name that

Q148: Calculation of unknown rent and interest.

Pine Leasing

Q149: Jamison Company uses IFRS for its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents