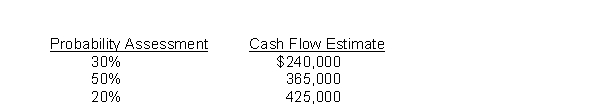

Reegan Company owns a trade name that was purchased in an acquisition of Hamilton Company. The trade name has a book value of $1,800,000, but according to IFRS, it is assessed for impairment on an annual basis. To perform this impairment test, Reegan must estimate the fair value of the trade name. It has developed the following cash flow estimates related to the trade name based on internal information. Each cash flow estimate reflects Reegan's estimate of annual cash flows over the next 7 years. The trade name is assumed to have no residual value after the 7 years. (Assume the cash flows occur at the end of each year.)  Reegan determines that the appropriate discount rate for this estimation is 6%. To the nearest dollar, what is the estimated fair value of the trade name?

Reegan determines that the appropriate discount rate for this estimation is 6%. To the nearest dollar, what is the estimated fair value of the trade name?

A) $1,800,000

B) $ 339,500

C) $1,030,000

D) $1,895,218

Correct Answer:

Verified

Q142: IFRS does not intend to issue detailed

Q143: Maxim Company leased an office under a

Q144: Present value of an ordinary annuity due.

Jill

Q145: Finding the implied interest rate.

Bates Company has

Q146: Under IFRS, the discount rate should reflect

Q148: Calculation of unknown rent and interest.

Pine Leasing

Q149: Jamison Company uses IFRS for its

Q150: Deferred annuity.

Carey Company owns a plot of

Q151: Under IFRS, if an estimate is being

Q152: Under IFRS, the rate implicit in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents