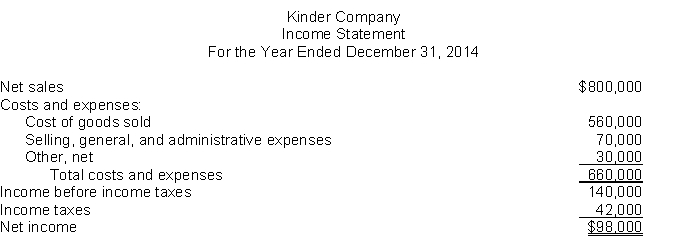

Single-step income statement.Presented below is an income statement for Kinder Company for the year ended December 31, 2014.  Additional information:1. "Selling, general, and administrative expenses" included a usual but infrequent charge of $7,000 due to a loss on the sale of investments.2. "Other, net" consisted of interest expense, $10,000, and an extraordinary loss of $20,000 before taxes due to earthquake damage. If the extraordinary loss had not occurred, income taxes for 2014 would have been $48,000 instead of $42,000."4. Kinder had 20,000 shares of common stock outstanding during 2014.

Additional information:1. "Selling, general, and administrative expenses" included a usual but infrequent charge of $7,000 due to a loss on the sale of investments.2. "Other, net" consisted of interest expense, $10,000, and an extraordinary loss of $20,000 before taxes due to earthquake damage. If the extraordinary loss had not occurred, income taxes for 2014 would have been $48,000 instead of $42,000."4. Kinder had 20,000 shares of common stock outstanding during 2014.

InstructionsUsing the single-step format, prepare a corrected income statement, including the appropriate per share disclosures."

Correct Answer:

Verified

Q129: If a company prepares a consolidated income

Q130: Multiple-step income statement.Presented below is information related

Q131: Boston Company owns more than 50 percent

Q132: The IFRS income statement classification of expenses

Q133: An IFRS statement might include all of

Q134: Irregular items and financial statements.The accountant preparing

Q135: IFRS allows for revaluation of long-term tangible

Q136: Under IFRS, both revenues and expenses and

Q137: Discontinued operations of a component of a

Q138: Multiple-step income statement.Shown below is an income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents