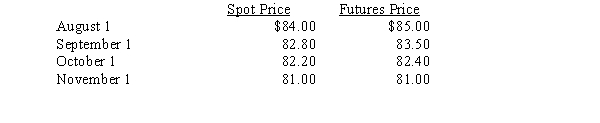

On August 1, an oil producer decided to hedge the fair value of its inventory by acquiring a futures contract to sell 100,000 barrels of oil on November 1 for $85.00 each. Price data follow:  What was the fair value of the contract on October 1?

What was the fair value of the contract on October 1?

A) $280,000

B) $110,000

C) $260,000

D) $20,000

Correct Answer:

Verified

Q24: With respect to derivative instruments that are

Q25: An advantage of a fair value hedge

Q26: Which of the following is true of

Q27: A hedge to avoid the potential unfavorable

Q27: On August 9, Jacobs Company buys 25

Q28: On February 1, Durham Company writes a

Q36: Which of the following has an asymmetric

Q37: On May 1 of the current year,

Q41: At the beginning of 20X5, a derivative

Q50: All of the following are examples of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents