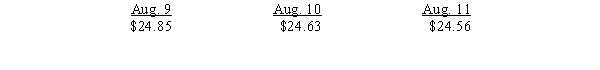

On August 9, Jacobs Company buys 25 contracts on Nymex to receive December delivery of Brent Crude Oil. Each contract is in units of 1,000 bbls at a futures price of $24.85 per bbl. The initial margin on the contract is set at $25,000, with a maintenance margin of $19,000. The futures prices are as follows:

Required:

a.Journalize the entries for Jacobs Company for the first three days of the contract.

b.Why are forward prices discounted and future prices are not discounted?

Correct Answer:

Verified

Q24: With respect to derivative instruments that are

Q25: On August 1, an oil producer decided

Q25: An advantage of a fair value hedge

Q26: Which of the following is true of

Q28: On February 1, Durham Company writes a

Q32: On September 23, Gensil Company buys 40

Q36: Which of the following has an asymmetric

Q38: Interest rate swaps

A)are a type of Futures

Q41: At the beginning of 20X5, a derivative

Q50: All of the following are examples of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents