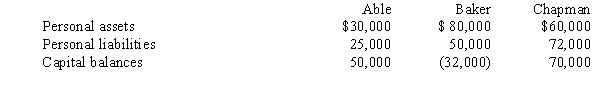

Partners Able, Baker, and Chapman have the following personal assets, personal liabilities, and partnership capital balances:  Assume profits and losses are allocated equally.

Assume profits and losses are allocated equally.

If Baker is in bankruptcy and is able to make a contribution, the capital balance for Able would be

A) $50,000.

B) $48,000.

C) $49,000.

D) $49,610.

Correct Answer:

Verified

Q18: Assume the existing capital of a partnership

Q19: The fair market value of a partnership

Q20: Under the goodwill method,

A)declines in asset values

Q21: When a new partner buys an ownership

Q22: Hetzer and Whalen partnership is insolvent and

Q24: Which of the following characterizes the bonus

Q25: Verst, Brown and Sullivan have a partnership.

Q26: If goodwill is suggested by the consideration

Q27: Under the Revised Uniform Partnership Agreement,

A)unsatisfied partnership

Q28: Verst, Brown and Sullivan have a partnership.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents