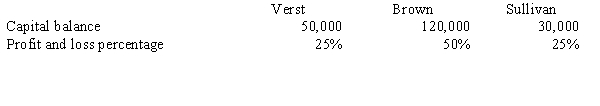

Verst, Brown and Sullivan have a partnership. Pertinent information is as follows:  Sullivan retires and the partnership pays him $35,000. What is the balance in Verst's capital account after the sale assuming this transaction was accounted for using the bonus method?

Sullivan retires and the partnership pays him $35,000. What is the balance in Verst's capital account after the sale assuming this transaction was accounted for using the bonus method?

A) 50,000

B) 51,667

C) 45,000

D) 48,333

Correct Answer:

Verified

Q20: Under the goodwill method,

A)declines in asset values

Q21: When a new partner buys an ownership

Q22: Hetzer and Whalen partnership is insolvent and

Q23: Partners Able, Baker, and Chapman have the

Q24: Which of the following characterizes the bonus

Q26: If goodwill is suggested by the consideration

Q27: Under the Revised Uniform Partnership Agreement,

A)unsatisfied partnership

Q28: Verst, Brown and Sullivan have a partnership.

Q29: Allen, Branden & Caylin are in the

Q30: If an existing partner withdraws from a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents