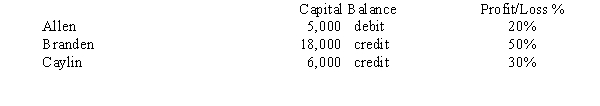

Allen, Branden & Caylin are in the process of liquidating their partnership. They have the following capital balances and profit and loss percentages:  The partnership balance sheet shows cash of $5,000, non-cash assets of $14,000, and no liabilities. Assuming no liquidation expenses, what safe payment could be made?

The partnership balance sheet shows cash of $5,000, non-cash assets of $14,000, and no liabilities. Assuming no liquidation expenses, what safe payment could be made?

A) $5,000 split between Branden & Caylin by a ratio of 5/8 and 3/8, respectively.

B) $5,000 to Branden only

C) $1,000 to Allen, $2,500 to Branden, and $1,500 to Caylin

D) $18,000 to Branden only

Correct Answer:

Verified

Q24: Which of the following characterizes the bonus

Q25: Verst, Brown and Sullivan have a partnership.

Q26: If goodwill is suggested by the consideration

Q27: Under the Revised Uniform Partnership Agreement,

A)unsatisfied partnership

Q28: Verst, Brown and Sullivan have a partnership.

Q30: If an existing partner withdraws from a

Q31: Below are steps in which partnership distribution

Q32: Verst, Brown and Sullivan have a partnership.

Q33: Assume that a partnership had assets with

Q34: Which of the following is not an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents