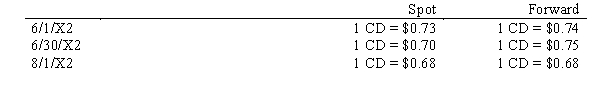

On 6/1/X2, an American firm purchased a inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/X2. Also on 6/1/X2, the American firm entered into a forward contract to purchase 100,000 Canadian dollars for delivery on 8/1/X2. The exchange rates were as follows:  The American firm's fiscal year end is 6/30/X2. The changes in the value of the forward contract should be discounted at 8%. What is the recorded value of the Forward Contract on 6/1/X2?

The American firm's fiscal year end is 6/30/X2. The changes in the value of the forward contract should be discounted at 8%. What is the recorded value of the Forward Contract on 6/1/X2?

A) $73,000

B) $74,000

C) $68,000

D) $0

Correct Answer:

Verified

Q21: Exchange gains and losses on a forward

Q30: On August 1, 20X1, an American firm

Q33: On 6/1/X2, an American firm purchased a

Q35: To qualify for fair value hedge accounting,

Q36: The time value of an option is

Q36: The two distinguishing characteristics of a derivative

Q37: Happ, Inc. agreed to purchase merchandise from

Q38: A fair value hedge may include hedges

Q38: On 6/1/X2, an American firm sold inventory

Q40: Which is true of foreign currency forward

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents