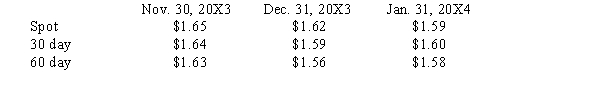

Happ, Inc. agreed to purchase merchandise from a British vendor on November 30, 20X3. The goods will arrive on January 31, 20X4 and payment of 100,000 British pounds is due at that time. On November 30, 20X3, Happ signed an agreement with a foreign exchange broker to buy 100,000 British pounds on January 31, 20X4. Exchange rates to purchase 1 British pound are as follows:  Because of this commitment hedge, Happ, Inc. will record the merchandise at what value when it arrives in January?

Because of this commitment hedge, Happ, Inc. will record the merchandise at what value when it arrives in January?

A) $165,000

B) $164,000

C) $163,000

D) $159,000

Correct Answer:

Verified

Q21: Exchange gains and losses on a forward

Q33: On 6/1/X2, an American firm purchased a

Q35: On 6/1/X2, an American firm purchased a

Q35: To qualify for fair value hedge accounting,

Q36: The two distinguishing characteristics of a derivative

Q36: The time value of an option is

Q38: On 6/1/X2, an American firm sold inventory

Q40: Which is true of foreign currency forward

Q42: On 6/1/X2, an American firm purchased a

Q60: In the accounting for forward exchange contracts,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents