Wolters Corporation is a U.S. corporation that purchased 50,000 chocolate bars from a foreign manufacturer on March 1, 20X9 for 80,000 foreign currency units, to be paid on April 30, 20X9. On March 1, 20X9 Wolters also entered into a forward contract to purchase 80,000 foreign currency units on April 30, 20X9. Wolters has a March 31 year end.

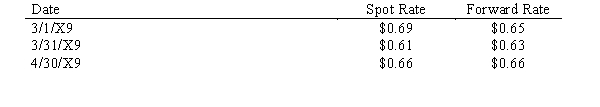

Exchange rates are as follows:

Required:

Prepare the journal entries to record the transactions through April 30, 20X9. March 31 is the fiscal period end. Ignore the split between spot gain/loss and time value.

Correct Answer:

Verified

Q53: Wolters Corporation is a U.S. corporation that

Q54: On January 1, 20X1, a U.S. firm

Q55: Which of the following statements is true

Q55: The accounting treatment given a cash flow

Q56: Zerlie's Imports purchased automotive parts from a

Q59: A U.S. Corp. purchased a computer from

Q60: On September 15, 20X2, Wall Company, a

Q61: Bulldog Enterprise, a U.S. firm, agreed on

Q63: On 7/1, a company forecasts the purchase

Q74: Describe the risks and uncertainty a U.S.company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents