Zerlie's Imports purchased automotive parts from a German firm on July 1, 20X1. The parts cost 150,000 Euros to be paid for on August 15. To pay for the parts, Zerlie's Imports borrowed 150,000 euros from a German bank on July 16. The loan bears an 11% interest rate to be repaid on August 15 in euros.

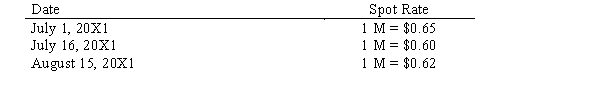

Another option would have been for Zerlie's to have hedged the purchase with a forward exchange contract on July 1 to buy 150,000 euros at a forward rate of $0.67. Exchange rates were as follows:

Required:

a.Compute the effect on net income assuming the following:(1)Zerlie did not borrow to pay for the transaction or hedge the transaction on July 1.(2)Zerlie borrowed from the German bank on July 16.(3)Zerlie hedged the full purchase on July 1.** ignore present values and discount rates

b.Determine which of these three alternatives would have been the best for Zerlie under the situation described.

Correct Answer:

Verified

Q45: In a hedge of a forecasted transaction,

Q52: On November 1, 20X1, a U.S. company

Q53: Wolters Corporation is a U.S. corporation that

Q54: On January 1, 20X1, a U.S. firm

Q55: The accounting treatment given a cash flow

Q55: Which of the following statements is true

Q58: Wolters Corporation is a U.S. corporation that

Q59: A U.S. Corp. purchased a computer from

Q60: On September 15, 20X2, Wall Company, a

Q61: Bulldog Enterprise, a U.S. firm, agreed on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents