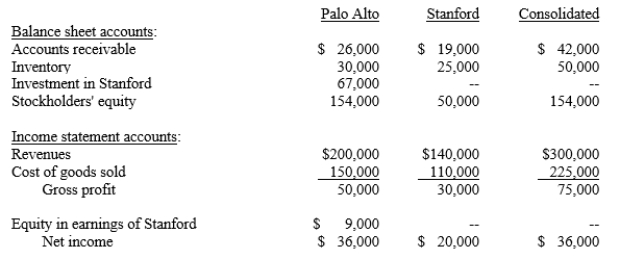

Selected information from the separate and consolidated balance sheets and income statements of Palo Alto, Inc. and its subsidiary, Stanford Co., as of December 31, 20X1, and for the year then ended is as follows:

Additional information:

During 20X1, Palo Alto sold goods to Stanford at the same markup on cost that Palo Alto uses for all sales. At December 31, 20X1, Stanford had not paid for all of these goods and still held 50% of them in inventory.

Palo Alto acquired its interest in Stanford five years earlier (as of December 31, 20X1).

Required:

For each of the following items, calculate the required amount.

a.The amount of intercompany sales from Palo Alto to Stanford during 20X1.

b.The amount of Stanford's payable to Palo Alto for intercompany sales as of December 31, 20X1.

c.In Palo Alto's December 31, 20X1, consolidated balance sheet, the carrying amount of the inventory that Stanford purchased from Palo Alto.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: On January 1, 20X1, a parent loaned

Q29: During 20X3, a parent company billed its

Q30: Phelps Co. uses the sophisticated equity method

Q31: On January 1, 20X1, Parent Company acquired

Q32: Patti Corp. has several subsidiaries (Aeta, Beta,

Q33: On January 1, 20X1, Pinto Company purchased

Q36: On January 1, 20X1, Parent Company acquired

Q37: On January 1, 20X1, Prange Company acquired

Q38: On January 1, 20X1, Prange Company acquired

Q42: For each of the following intercompany transactions,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents