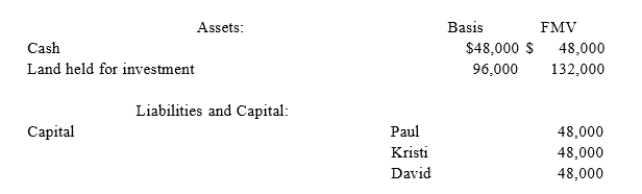

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000. Just prio7r4) to the sale, Paul's outside and inside bases in KDP are $48,000. KDP's balance sheet includes the following:  If KDP has a §754 election in place, what is Kathy's special basis adjustment?

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

A) $36,000.

B) $12,000.

C) $0.

D) None of the choices are correct.

Correct Answer:

Verified

Q75: Tyson is a 25% partner in the

Q76: Brian is a 25% partner in the

Q77: The VRX Partnership (a calendar year-end entity)

Q78: Tyson is a 25% partner in the

Q79: Tyson is a 25% partner in the

Q82: Tatia's basis in her TRQ partnership interest

Q83: BPA Partnership is an equal partnership in

Q85: Esther and Elizabeth are equal partners in

Q99: Scott is a 50% partner in the

Q107: Tyson, a one-quarter partner in the TF

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents