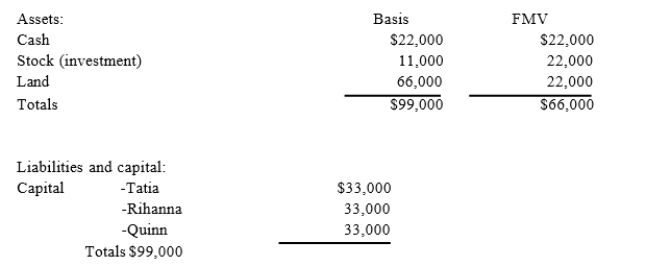

Tatia's basis in her TRQ partnership interest is $33,000. Tatia receives a distribution of $22,000 cash from TRQ in complete liquidation of her interest. The three partners in TRQ share profits, losses, and capital equally. TRQ has the following balance sheet:  a. What is the amount and character of Tatia's recognized gain or loss? What is the effect on the partnership assets?b. If TRQ has a §754 election in place, what is the amount of the special basis adjustment?

a. What is the amount and character of Tatia's recognized gain or loss? What is the effect on the partnership assets?b. If TRQ has a §754 election in place, what is the amount of the special basis adjustment?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: The VRX Partnership (a calendar year-end entity)

Q78: Tyson is a 25% partner in the

Q79: Tyson is a 25% partner in the

Q80: Kathy purchases a one-third interest in the

Q83: BPA Partnership is an equal partnership in

Q85: Esther and Elizabeth are equal partners in

Q87: Marty is a 40% owner of MB

Q99: Scott is a 50% partner in the

Q107: Tyson, a one-quarter partner in the TF

Q115: Tyson, a one-quarter partner in the TF

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents