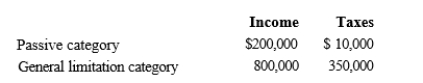

Britta, Inc., a U.S.corporation, reports foreign-source income and pays foreign taxes as follows.  Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $336,000 assume a 21% tax rate).What is Britta's U.S.tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $336,000 assume a 21% tax rate).What is Britta's U.S.tax liability after the FTC?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: With respect to income generated by non-U.S.

Q124: Match each of the following items with

Q126: Discuss the primary purposes of income tax

Q127: Match each of the following terms with

Q136: Milt Corporation owns and operates two facilities

Q139: Given the following information, determine if FanCo,

Q164: Compost Corporation has finished its computation of

Q173: What is the significance of the term

Q189: State Q wants to increase its income

Q200: Discuss how a multistate business divides up

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents