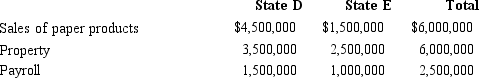

Milt Corporation owns and operates two facilities that manufacture paper products.One of the facilities is located in State D, and the other is located in State E.Milt generated $1,200,000 of taxable income, comprised of $1,000,000 of income from its manufacturing facilities and a $200,000 gain from the sale of nonbusiness property located in E.E does not distinguish between business and nonbusiness property.D apportions business income.Milt's activities within the two states are outlined below.

Both D and E utilize a three-factor apportionment formula, under which sales, property, and payroll are equally weighted.Determine the amount of Milt's income that is subject to income tax by each state.

Both D and E utilize a three-factor apportionment formula, under which sales, property, and payroll are equally weighted.Determine the amount of Milt's income that is subject to income tax by each state.

Correct Answer:

Verified

Q124: Match each of the following items with

Q126: Discuss the primary purposes of income tax

Q127: Match each of the following terms with

Q129: Match each of the following items with

Q132: Compute Still Corporation's State Q taxable income

Q139: Match each of the following items with

Q139: Given the following information, determine if FanCo,

Q140: Britta, Inc., a U.S.corporation, reports foreign-source income

Q151: Match each of the following items with

Q173: What is the significance of the term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents