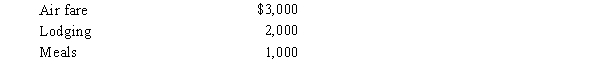

During the year, Walt self-employed) travels from Seattle to Tokyo Japan) on business.His time was spent as follows: 2 days travel one day each way), 2 days business, and 2 days personal.His expenses for the trip were as follows meals and lodging reflect only the business portion):  Presuming no reimbursement, Walt's deductible expenses are:

Presuming no reimbursement, Walt's deductible expenses are:

A)$3,500.

B)$4,500.

C)$5,500.

D)$6,000.

E)None of these.

Correct Answer:

Verified

Q42: Qualified business income (QBI) is defined as

Q57: A qualified trade or business includes any

Q59: A taxpayer who claims the standard deduction

Q64: When using the automatic mileage method, which,

Q64: Qualified business income includes the reasonable compensation

Q74: Allowing for the overall limitation (50% reduction

Q86: The § 222 deduction for tuition and

Q115: Corey is the city sales manager for

Q118: Aaron is a self-employed practical nurse who

Q121: Ralph made the following business gifts during

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents