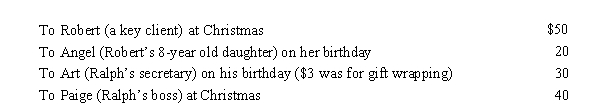

Ralph made the following business gifts during the year.  Presuming proper substantiation, Ralph's deduction is:

Presuming proper substantiation, Ralph's deduction is:

A) $0.

B) $53.

C) $73.

D) $78.

E) $98.

Correct Answer:

Verified

Q25: Tammy has $200,000 of QBI from her

Q42: Qualified business income (QBI) is defined as

Q57: A qualified trade or business includes any

Q74: Allowing for the overall limitation (50% reduction

Q81: Fran is a CPA who has a

Q83: Which, if any, of the following expenses

Q85: Which of the following expenses, if any,

Q93: In contrasting the reporting procedures of employees

Q116: During the year, Walt self-employed) travels from

Q118: Aaron is a self-employed practical nurse who

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents