Use the following information for questions.

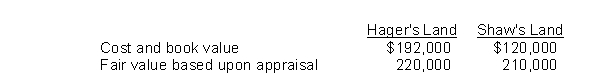

Two independent companies, Hager Co.and Shaw Co., are in the home building business.Each owns a tract of land held for development, but each would prefer to build on the other's land.They agree to exchange their land.An appraiser was hired, and from her report and the companies' records, the following information was obtained:

The exchange was made, and based on the difference in appraised fair values, Shaw paid $10,000 to Hager.The exchange has commercial substance.

-The new land should be recorded on Shaw's books at

A) $120,000.

B) $220,000.

C) $150,000.

D) $210,000.

Correct Answer:

Verified

Q127: Huff Co. exchanged nonmonetary assets with Sayler

Q128: Colt Football Co.had a player contract with

Q129: Use the following information for questions.

Two independent

Q130: Ecker Company purchased a new machine on

Q131: On September 10, 2010, Jenks Co.incurred the

Q132: Use the following information for questions.

Equipment that

Q133: Hoyle Company traded machinery with a book

Q134: A company is constructing an asset for

Q136: On December 1, 2010, Hogan Co.purchased a

Q137: Sutherland Company purchased machinery for $320,000 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents