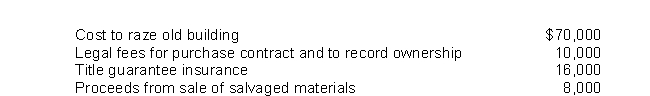

On December 1, 2010, Hogan Co.purchased a tract of land as a factory site for $800,000.The old building on the property was razed, and salvaged materials resulting from demolition were sold.Additional costs incurred and salvage proceeds realized during December 2010 were as follows:  In Hogan's December 31, 2010 statement of financial position, what amount should be reported as land?

In Hogan's December 31, 2010 statement of financial position, what amount should be reported as land?

A) $826,000.

B) $862,000.

C) $888,000.

D) $896,000.

Correct Answer:

Verified

Q127: Huff Co. exchanged nonmonetary assets with Sayler

Q128: Colt Football Co.had a player contract with

Q129: Use the following information for questions.

Two independent

Q130: Ecker Company purchased a new machine on

Q131: On September 10, 2010, Jenks Co.incurred the

Q132: Use the following information for questions.

Equipment that

Q133: Hoyle Company traded machinery with a book

Q134: A company is constructing an asset for

Q135: Use the following information for questions.

Two independent

Q137: Sutherland Company purchased machinery for $320,000 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents