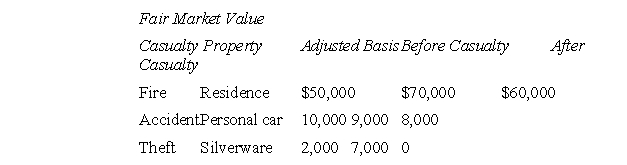

M had three separate casualties involving personal use property during the current year:  M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.What is M's deductible gain (or loss) on each casualty, respectively, before any percentage limit?

M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.What is M's deductible gain (or loss) on each casualty, respectively, before any percentage limit?

A) $1,900 loss, $200 loss, $3,000 gain

B) $2,000 loss, $300 loss, $3,000 gain

C) $10,000 loss, $1,000 loss, $7,000 loss

D) $10,000 gain, $2,000 loss, $2,000 loss

Correct Answer:

Verified

Q34: Options to purchase property are always treated

Q35: Which of the following is not an

Q36: K sold the following investments during the

Q37: A taxpayer can defer gain on the

Q38: Which of the following dispositions of property

Q40: Which of the following is not true

Q41: W and Y are married and file

Q42: During the current year, F, an individual,

Q43: Which of the following debt instruments are

Q44: K is a single, calendar year, individual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents