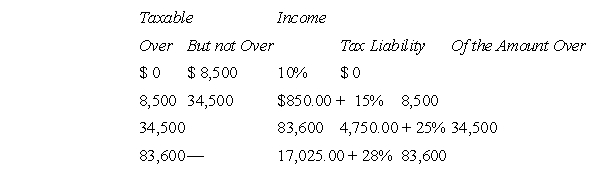

K is a single, calendar year, individual taxpayer.A net long-term (15 percent) capital gain of $10,000 is included in K's taxable income.The 2011 tax schedules for single taxpayers are as follows:  Which of the following is not true regarding the taxation of K's federal gross income tax for 2011?

Which of the following is not true regarding the taxation of K's federal gross income tax for 2011?

A) If K's taxable income is $70,000, all of the net capital gain is taxed at 15 percent.

B) If K's taxable income is $20,000, all of the net capital gain is taxed at 0 percent.

C) If K's taxable income is $40,000, the net capital gain is taxed at the same rate as it would have been had it been ordinary income.

D) If K's taxable income is $37,000, the net capital gain is taxed partly at 15 percent and partly at 0 percent.

Correct Answer:

Verified

Q39: M had three separate casualties involving personal

Q40: Which of the following is not true

Q41: W and Y are married and file

Q42: During the current year, F, an individual,

Q43: Which of the following debt instruments are

Q45: C had a long-term capital loss carryover

Q46: Dr.T recently called her tax adviser and

Q47: E always had eyes for a

Q48: J is a single, calendar year, individual

Q49: Q, who is single, acquired § 1244

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents