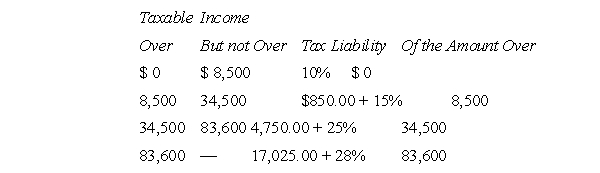

J is a single, calendar year, individual taxpayer.She has taxable income for the year 2011 of $65,000, including a net short-term capital loss of $5,000 and a net long-term (15 percent) capital gain of $10,000.The 2011 tax schedules for single taxpayers are as follows:  J's federal gross income tax for 2011 is

J's federal gross income tax for 2011 is

A) $16,875

B) $13,000

C) $11,875

D) $11,375

Correct Answer:

Verified

Q43: Which of the following debt instruments are

Q44: K is a single, calendar year, individual

Q45: C had a long-term capital loss carryover

Q46: Dr.T recently called her tax adviser and

Q47: E always had eyes for a

Q49: Q, who is single, acquired § 1244

Q50: K had short-term capital losses of $2,000

Q51: G is a single, calendar year, individual

Q52: During the current year, J had long-term

Q53: D purchased an option to acquire 3

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents