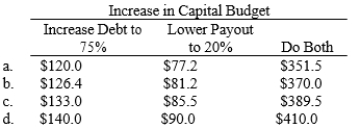

DeAngelo Corp.'s projected net income is $150.0 million, its target capital structure is 25% debt and 75% equity, and its target payout ratio is 65%. DeAngelo has more positive NPV projects than it can finance without issuing new stock, but its board of directors had decreed that it cannot issue any new shares in the foreseeable future. The CFO now wants to determine how the maximum capital budget would be affected by changes in capital structure policy and/or the target dividend payout policy. Versus the current policy, how much larger could the capital budget be if (1) the target debt ratio were raised to 75%, other things held constant, (2) the target payout ratio were lowered to 20%, other things held constant, and (3) the debt ratio and payout were both changed by the indicated amounts.

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q29: Blease Inc.has a capital budget of $625,000,and

Q36: Brammer Corp.'s projected capital budget is $1,000,000,its

Q42: Sheehan Corp.is forecasting an EPS of $3.00

Q44: Grullon Co.is considering a 7-for-3 stock split.The

Q49: D&P Co.has a capital budget of $2,000,000.The

Q53: Toombs Media Corp.recently completed a 3-for-1 stock

Q56: Whited Products recently completed a 4-for-1 stock

Q57: Brooks Corp.'s projected capital budget is $2,000,000,its

Q64: The following data apply to Grullon-Ikenberry Inc.

Q65: Pavlin Corp.'s projected capital budget is $2,000,000,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents