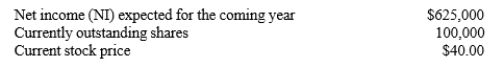

The following data apply to Grullon-Ikenberry Inc. (GII) :  The company is in a mature industry. Therefore, it plans to distribute all of its income at year-end, and its earnings are not expected to grow. The CFO is now deciding whether to distribute income to stockholders as dividends or to use the funds to repurchase common stock. She believes the P/E ratio will not be affected by a repurchase. Moreover, she believes that the stock can be repurchased at the end of the year at the then-current price, which is expected to be the now-current price plus the dividend that would otherwise be received at year-end. Disregarding any possible tax effects, how much would a stockholder who owns 100 shares gain if the firm used its net income to repurchase stock rather than for dividends?

The company is in a mature industry. Therefore, it plans to distribute all of its income at year-end, and its earnings are not expected to grow. The CFO is now deciding whether to distribute income to stockholders as dividends or to use the funds to repurchase common stock. She believes the P/E ratio will not be affected by a repurchase. Moreover, she believes that the stock can be repurchased at the end of the year at the then-current price, which is expected to be the now-current price plus the dividend that would otherwise be received at year-end. Disregarding any possible tax effects, how much would a stockholder who owns 100 shares gain if the firm used its net income to repurchase stock rather than for dividends?

A) $564.06

B) $593.75

C) $625.00

D) $656.25

Correct Answer:

Verified

Q29: Blease Inc.has a capital budget of $625,000,and

Q36: Brammer Corp.'s projected capital budget is $1,000,000,its

Q42: Sheehan Corp.is forecasting an EPS of $3.00

Q44: Grullon Co.is considering a 7-for-3 stock split.The

Q49: D&P Co.has a capital budget of $2,000,000.The

Q53: Toombs Media Corp.recently completed a 3-for-1 stock

Q56: Whited Products recently completed a 4-for-1 stock

Q57: Brooks Corp.'s projected capital budget is $2,000,000,its

Q63: DeAngelo Corp.'s projected net income is $150.0

Q65: Pavlin Corp.'s projected capital budget is $2,000,000,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents