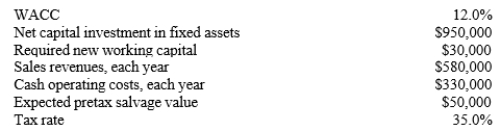

Majestic Theaters is considering investing in some new projection equipment whose data are shown below. The required equipment has a 7-year project life falling into a CCA class of 30%, but it would have a positive pre-tax salvage value at the end of Year 7. Also, some new working capital would be required, but it would be recovered at the end of the project's life. Revenues and cash operating costs are expected to be constant over the project's 7-year life. What is the project's NPV?

A) $13,965

B) $15,226

C) $16,910

D) $17,882

Correct Answer:

Verified

Q59: You work for Athens Inc., and you

Q60: Fool Proof Software is considering a new

Q62: California Hideaways is considering a new project

Q63: Party Place is considering a new investment

Q64: Dumpe Industries is analyzing an average-risk project,

Q66: Easy Payment Loan Company is thinking of

Q67: Merritt Company is considering a new project

Q68: TexMex Products is considering a new salsa

Q69: Moore & Moore (MM) is considering the

Q72: Bing Services is now in the final

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents