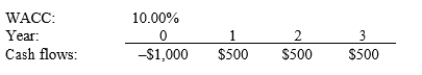

Garvin Enterprises is considering a project that has the following cash flow and WACC data. What is the project's discounted payback?

A) 2.12 years

B) 2.35 years

C) 2.59 years

D) 2.85 years

Correct Answer:

Verified

Q80: Levin Company is considering a project that

Q81: Hindelang Inc. is considering a project that

Q82: Anderson Associates is considering two mutually exclusive

Q83: Last month, Smith Systems Inc. decided to

Q84: Rivoli Roofing is considering mutually exclusive Projects

Q87: Flint Fruits is considering two equally risky,

Q88: Pinkerton Truck Rental is considering two mutually

Q88: The Bank of Canada recently shifted its

Q89: Aubey Inc. is considering two projects that

Q92: A small manufacturer is considering two alternative

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents