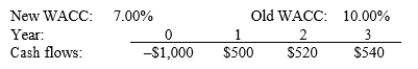

The Bank of Canada recently shifted its monetary policy, causing Lasik Vision's WACC to change. Lasik had recently analyzed the project whose cash flows are shown below. However, the CFO wants to reconsider this and all other proposed projects in view of the Bank of Canada's action. How much did the changed WACC cause the forecasted NPV to change? Assume that the Bank of Canada's action does not affect the cash flows, and note that a project's projected NPV can be negative, in which case it should be rejected.

A) $72.27

B) $75.88

C) $79.68

D) $83.66

Correct Answer:

Verified

Q83: Last month, Smith Systems Inc. decided to

Q84: Rivoli Roofing is considering mutually exclusive Projects

Q85: Garvin Enterprises is considering a project that

Q85: Mills Corp.is considering two mutually exclusive machines.Machine

Q87: Flint Fruits is considering two equally risky,

Q88: Pinkerton Truck Rental is considering two mutually

Q89: Aubey Inc. is considering two projects that

Q91: ZumBahlen Inc. is considering the following mutually

Q92: A small manufacturer is considering two alternative

Q92: Walker & Campsey wants to invest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents