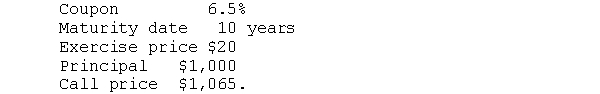

A firm has both a convertible bond and a convertible preferred stock outstanding. The convertible bond has the following features:  The convertible preferred stock has the following features:Annual dividend $2.25Convertible into 2.5 shares of common stockCallable at $25 a share.Currently the common stock is selling for $13; the yield on non convertible bonds is 10%, and the yield on comparable preferred stocks is 14%. What is the value of the above securities in terms of the common stock What would be the value of each security if it lacked the conversion feature SOLUTIONS TO THE PROBLEMS

The convertible preferred stock has the following features:Annual dividend $2.25Convertible into 2.5 shares of common stockCallable at $25 a share.Currently the common stock is selling for $13; the yield on non convertible bonds is 10%, and the yield on comparable preferred stocks is 14%. What is the value of the above securities in terms of the common stock What would be the value of each security if it lacked the conversion feature SOLUTIONS TO THE PROBLEMS

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Convertible preferred stock

1. pays a fixed dividend

2.

Q33: When a convertible bond is called,

1. interest

Q35: As the price of common stock rises,

A)the

Q38: Put bonds tend to have lower coupons

Q43: A convertible bond's payback period

1. increases as

Q44: A $50 par value convertible preferred stock

Q45: If an investor expects the firm to

Q46: The interest paid by a convertible bond

Q46: Corporation HBM has a convertible bond with

Q47: Given the information below, answer the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents