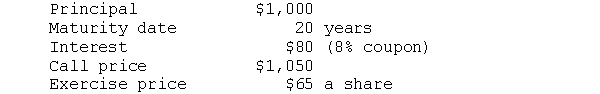

Given the information below, answer the following questions.A convertible bond has the following features:

a. The bond may be converted into how many shares?

b. If comparable non-convertible debt offered an annual yield of 12 percent, what would be the value of this bond as debt?

c. If the stock were selling for $52, what is the value of the bond in terms of stock?

d. Would you expect the bond to sell for its value as debt (i.e., the value determined in b) if the price of the stock were $52?

e. If the price of the bond were $960, what are the premiums paid over the bond's value as stock and its value as debt?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Convertible preferred stock

1. pays a fixed dividend

2.

Q33: When a convertible bond is called,

1. interest

Q35: As the price of common stock rises,

A)the

Q38: Put bonds tend to have lower coupons

Q43: A convertible bond's payback period

1. increases as

Q44: A firm has both a convertible bond

Q44: A $50 par value convertible preferred stock

Q45: If an investor expects the firm to

Q46: Corporation HBM has a convertible bond with

Q46: The interest paid by a convertible bond

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents