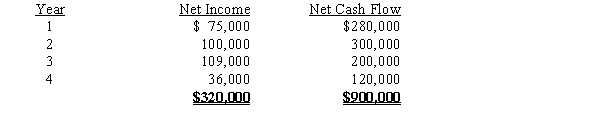

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of four years and no salvage value. The estimated net income and net cash flow from the project are as follows:?  The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for Years 1 through 4 is 0.893, 0.797, 0.712, and 0.636, respectively.Determine the net present value.

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for Years 1 through 4 is 0.893, 0.797, 0.712, and 0.636, respectively.Determine the net present value.

Correct Answer:

Verified

Q179: Jimmy Co. is considering a 12-year project

Q180: Proposals M and N each cost $550,000,

Q181: Project A requires an original investment

Q182: Sunrise Inc. is considering a capital investment

Q183: A $400,000 capital investment proposal has an

Q184: The net present value has been computed

Q185: A $550,000 capital investment proposal has an

Q186: An investment of $185,575 is expected to

Q187: Briefly describe the time value of money.

Q188: Project A requires an original investment of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents