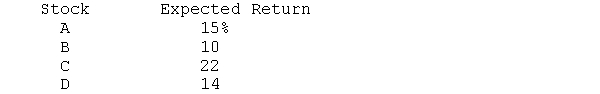

What is the expected return on a portfolio consisting of an equal amount invested in each stock?

b. What is the expected return on the portfolio if 50 percent of the funds are invested in stock C, 30 percent in stock A, and 20 percent in Stock D?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Portfolio risk encompasses

1. a firm's financing decisions

2.

Q21: The numerical value of beta for the

Q22: Low beta stocks tend to generate higher

Q30: If a beta coefficient is 1.7, that

Q41: Beta coefficients

1) are a measure of systematic

Q44: This problem illustrates the computation of beta

Q45: Investors who want to bear less risk

Q45: An efficient portfolio

1. maximizes risk for a

Q46: The efficient frontier in portfolio theory

A)indicates the

Q48: According to the arbitrage pricing theory, the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents