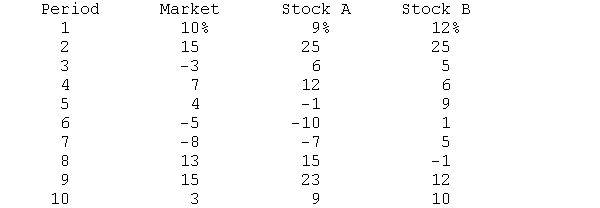

This problem illustrates the computation of beta coefficients may be solved using a statistics program or Excel.) The returns on the market and stock A and stock B are as follows:

Compute the beta coefficient for each stock and interpret the results of the computations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Portfolio risk encompasses

1. a firm's financing decisions

2.

Q21: The numerical value of beta for the

Q22: Low beta stocks tend to generate higher

Q41: Beta coefficients

1) are a measure of systematic

Q43: What is the expected return on a

Q45: Investors who want to bear less risk

Q45: An efficient portfolio

1. maximizes risk for a

Q46: The efficient frontier in portfolio theory

A)indicates the

Q48: According to the arbitrage pricing theory, the

Q55: Beta coefficients of 1.3 indicate

A)the stock has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents