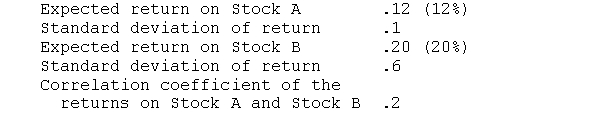

Given the following information:

a. What are the expected returns and standard deviations of the following portfolios:

1. 100 percent of funds invested in Stock A

2. 100 percent of funds invested in Stock B

3. 50 percent of funds invested in each stock?

b. What would be the impact if the correlation coefficient were ?0.6 instead of 0.2?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: For diversification to reduce risk,

A)the returns on

Q44: This problem illustrates the computation of beta

Q45: An efficient portfolio

1. maximizes risk for a

Q45: Investors who want to bear less risk

Q46: The efficient frontier in portfolio theory

A)indicates the

Q47: What is the expected return on a

Q48: According to the arbitrage pricing theory, the

Q52: The security market line does not

A)indicate the

Q53: If the dispersion around a stock's return

Q55: Beta coefficients of 1.3 indicate

A)the stock has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents