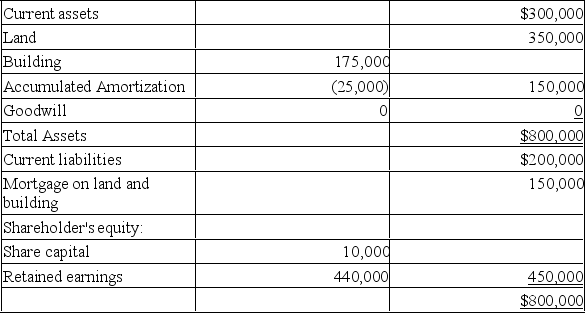

Mountain Wear Inc. (MWI) is a Canadian-controlled private corporation. Fred Martin is the sole shareholder. The PUC and ACB of Fred's shares is $10,000. The year-end balance sheet for MWI is as follows:

Additional information is available for MWI:

Additional information is available for MWI:

The current assets consist of accounts receivables and inventory, which have costs equal to their market values.

The UCC of the building is $160,000.

The land is currently valued at $450,000.

The building has a FMV of $205,000.

Goodwill has a FMV of $100,000.

Additional information:

Fred has used all of his capital gains deduction on previous QSBC share sales.

MWI is not associated with any other corporations for tax purposes.

Fred has recently been offered $450,000 for his shares by a local competitor.

Fred is in a 45% tax bracket on regular income, 28% on eligible dividends, and 37% on non-eligible dividends.

Due to the timing of the sale, if assets are sold, the small business deduction will be available for all business income.

The tax rate on earnings subject to the small business deduction is 13%, and 27% on additional business income.

The combined (federal and provincial) tax rate on corporate investment income is 50 2/3% and the refundable rate is 30 2/3%.

The eligible and non-eligible RDTOH balances prior to the sale were NIL.

Required:

A) Calculate the after-tax proceeds of the sale if the shares of MWI are sold.

B) Calculate the net cash available for wind-up from MWI in an asset sale. (The proceeds will be distributed to Fred by way of a dividend.)

(Round all amounts to zero decimal places.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents