KM Ltd. is a Canadian-controlled private corporation, operating a small gift store in Vancouver. The company has a December 31st year-end. KM's financial statements reported net income before taxes of $210,000 in 20x0.

Financial information relating to 20x0 is as follows:

Land adjacent to the gift shop was purchased with a $75,000 bank loan during the year to allow for an outdoor sales area during warm weather. Interest expense on the loan for the year was $9,600, and the appraisal fee to finance the loan was $1,000. Both the interest and the appraisal fee were expensed by KM in 20x0.

The company hired a contractor to landscape the land. The $5,000 bill for the landscaping was paid in full during the year and capitalized on KM's Balance Sheet.

During the year, a new display case worth $2,000 was purchased and expensed on the books.

Amortization expense of $21,000 was deducted during the year. Total CCA (following any adjustments) for the year was $16,000 and is not reflected in the financial statements.

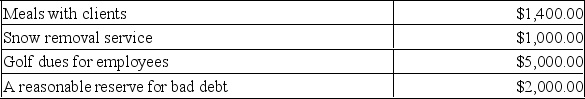

The following were also expensed during the year:

On December 30th, KM's president announced a bonus to be paid to the company's key employee in the amount of $5,000, which was expensed on the books that day. The employee will receive the bonus in 20x1 in equal payments of $2,500, to be issued on January 30th and July 30th.

On December 30th, KM's president announced a bonus to be paid to the company's key employee in the amount of $5,000, which was expensed on the books that day. The employee will receive the bonus in 20x1 in equal payments of $2,500, to be issued on January 30th and July 30th.

Required:

Determine KM Ltd.'s net income for tax purposes for 20x0.

Correct Answer:

Verified

Q1: Joe invested in a piece of land

Q1: Sam runs a proprietorship that generated $75,000

Q2: Determine whether the sale of the following

Q4: TriStar Industries was recently denied the deduction

Q4: A taxpayer recognized a $40,000 loss in

Q4: Which of the following expenses would be

Q6: Alice Smith has provided you with the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents