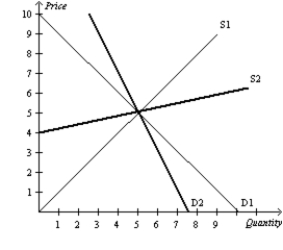

Figure 6-29

Suppose the government imposes a $2 on this market.

-Refer to Figure 6-29.Suppose D1 represents the demand curve for gasoline in both the short run and long run,S1 represents the supply curve for gasoline in the short run,and S2 represents the supply curve for gasoline in the long run.After the imposition of the $2,

A) buyers bear a higher burden of the tax in the short run than in the long run.

B) sellers bear a higher burden of the tax in the short run than in the long run.

C) buyers and sellers bear an equal burden of the tax in both the short run and long run.

D) buyers and sellers bear an equal burden of the tax in the short run,but buyers bear a higher burden of the tax in the long run.

Correct Answer:

Verified

Q181: The demand for salt is inelastic,and the

Q182: Figure 6-33

The diagram shows the effect of

Q183: Figure 6-29

Suppose the government imposes a $2

Q184: Assume the demand for cigarettes is relatively

Q185: Figure 6-29

Suppose the government imposes a $2

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents